IRS Example Attachments 1023 free printable template

Show details

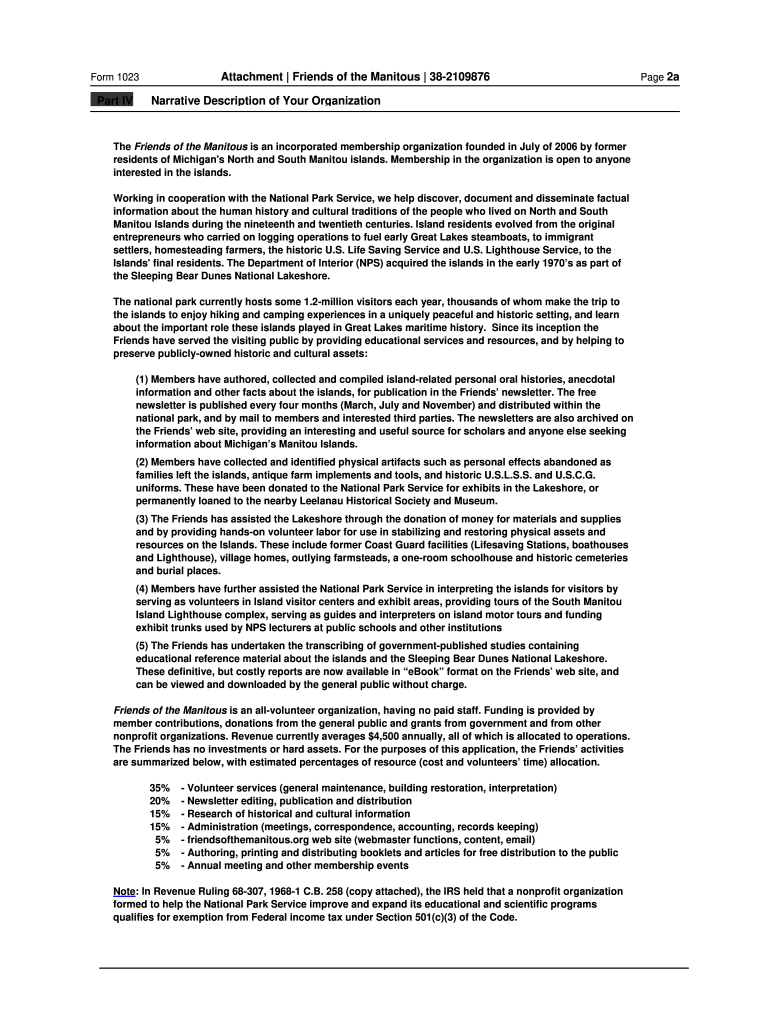

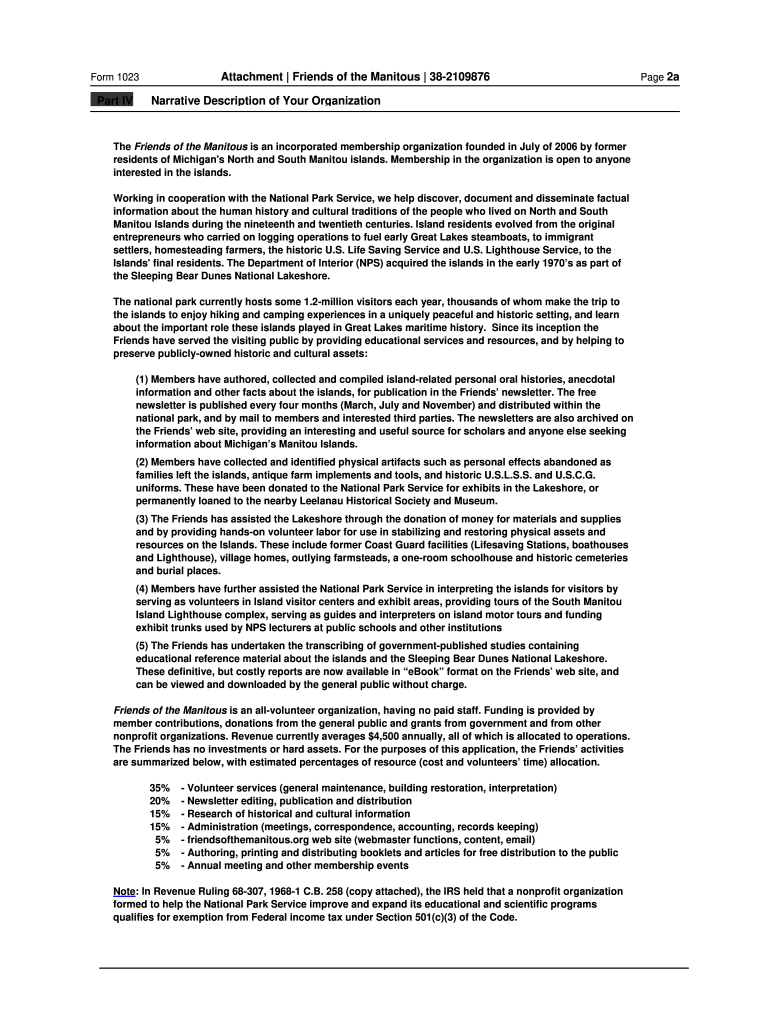

Attachment Friends of the Manitous 38-2109876 Form 1023 Part IV Narrative Description of Your Organization The Friends of the Manitous is an incorporated membership organization founded in July of 2006 by former residents of Michigan s North and South Manitou islands. Membership in the organization is open to anyone interested in the islands. Working in cooperation with the National Park Service we help discover document and disseminate factual information about the human history and cultural...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign irs form 1023

Edit your irs form 1023 pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 1023 example form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sample completed 1023 form online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit sample form 1023. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irs 501c3 application form 1023 printable

How to fill out IRS Example Attachments 1023

01

Gather necessary information about your organization, including its mission, programs, and financial data.

02

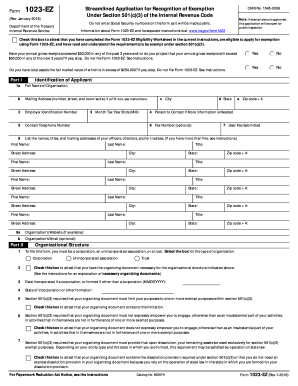

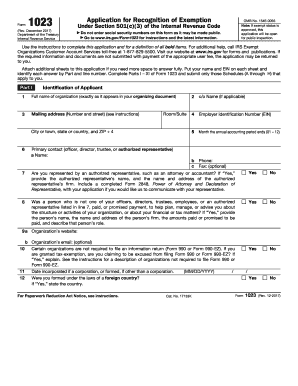

Complete Part I of IRS Form 1023 to provide basic information about your organization.

03

Fill out Part II to describe your organization’s structure, governance, and business activities.

04

In Part III, provide detailed information about your organization’s exempt purpose and the activities that further this purpose.

05

Complete Part IV by detailing the financial history of your organization, including a budget and sources of funding.

06

Attach the required schedules and any additional documentation that supports your application.

07

Review all information for accuracy and ensure all required signatures are included.

08

Submit the completed Form 1023 along with the appropriate filing fee to the IRS.

Who needs IRS Example Attachments 1023?

01

Organizations seeking federal tax-exempt status under Section 501(c)(3) of the Internal Revenue Code.

02

Non-profit organizations that engage in charitable, educational, or scientific activities.

03

Religious organizations that wish to apply for exemption from federal income tax.

Fill

irs form 1023 application

: Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

Fill out your IRS Example Attachments 1023 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sample 1023 Forms Completed is not the form you're looking for?Search for another form here.

Keywords relevant to writing keyword 1023

Related to irs form 1023 nonprofit

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.